Investing

Investing  No Comments

No Comments Selling Cash-Covered Puts

Selling Cash-Covered Puts

I mostly use Robinhood for option trades. Though I do trade some options in my E*TRADE Roth account, I’ll describe what I do when in Robinhood.

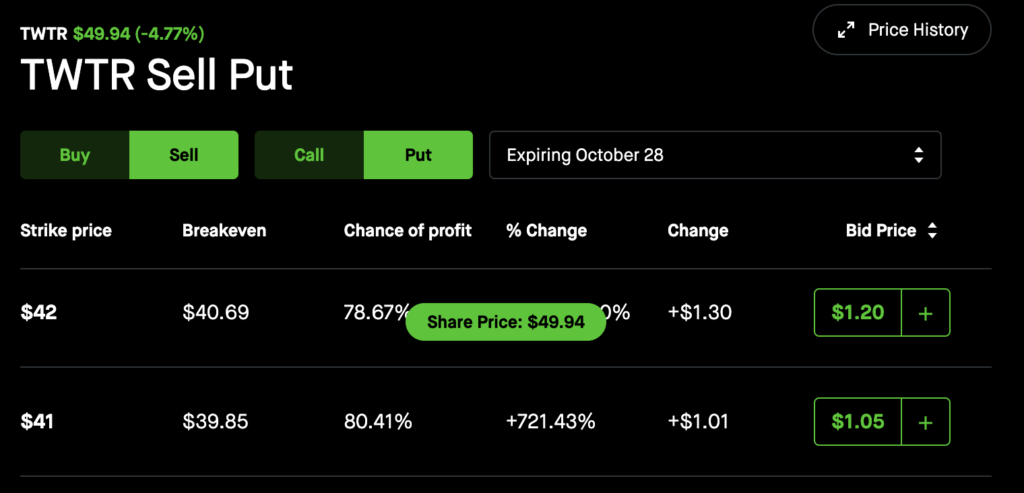

Assume I’m interested in selling puts on Twitter (TWTR). The stock has had its ups and downs as Elon Musk decides whether he does or does not want to own Twitter. In the meantime I can earn money on the price fluctuations. To start with, I look at the options rates for the coming week. Robinhood makes it pretty simple to calculate the risk profile of the trade through their “Chance of profit” value. When selling puts I look for the venn diagram of:

- The duration is 2 weeks or less

- The “chance of profit” value is greater than 80%

- The return rate on the trade is > 1.5%

- I wouldn’t kick myself for owning the stock if the position is assigned

In the case of TWTR, the 10/28 puts with a strike price of $41 are in my sweet spot. The chance of profit is > 80%. And the return rate for tying up $4,100 on a contract for the week is about 2.5%. As an added bonus: I like Twitter. I use Twitter. I would be OK owning a hundred shares of the stock at $41.

But what if things go wrong? you might ask. Well, in the case of a cash-covered put, the worst that can go wrong is that the option gets assigned. In this case, the stock price would have to drop more than 17% during the week. And if it does then in the week following I will immediately turn around and sell a covered call (add link) at or above the same strike price.

But what if things go really, really wrong? Like: what if we suffer a Black Monday type market correction, or the price of Twitter plummets severly to a point where selling covered calls at the original strike price is simply not doable?

Remember above when I said for stock investments I always calculate how much I’m willing to lose on an investment before I buy? Same is true here. Before I buy this option I will calculate what is my plan should the option be assigned and I own 100 shares of TWTR at $41 a pop? In the case of Twitter I’ve already assigned it a sentiment score of “C”, so my methodology dictates that I’m willing to risk losing 15% of my investment. At $41 a share purchase price that means I’ve already committed to selling should the price drop to $34.85. With that in mind, I execute the option. If the option is assigned, the next week I asses the opening price on Monday. If it’s near $34.85 (or below) I sell immediately, lick my wounds, and reassess what went wrong and how to prevent that from happening again. I do a trading retro, so to speak. But as long as the price is above that target sell price (or trending upward) I sell covered calls at no less than a $41 strike price until the position is either called, or the price reverses direction and I need to reassess once again.

This doesn’t remove all emotion from the trades, but it does give me a playbook to execute against – which is easier for me to unemotionally follow than dealing with whatever I might feel with every investment I might make. And when that doesn’t work, I pause. I’ll write more about pausing in the coming weeks.